How Biden’s Student Loan Debt Forgiveness Program Will Impact Creek Students

The Class of 2021 gathers at Stutler Bowl during last year’s graduation ceremony. In light of Biden’s debt forgiveness program, this year, some upperclassmen wonder if they will receive similar debt relief in the future. “My decision of going to college lies [in] how much money I have,” Junior Ikram Chichou said. “[There is] a higher opportunity that I will go to college if the student loan forgiveness continues. If not, then my life after high school has no plan.”

October 4, 2022

On Aug. 24, President Joe Biden announced the federal government would create a student loan debt forgiveness program and overhaul the current system for student loans. Though a national decision, this could impact the college decisions of future Creek graduates.

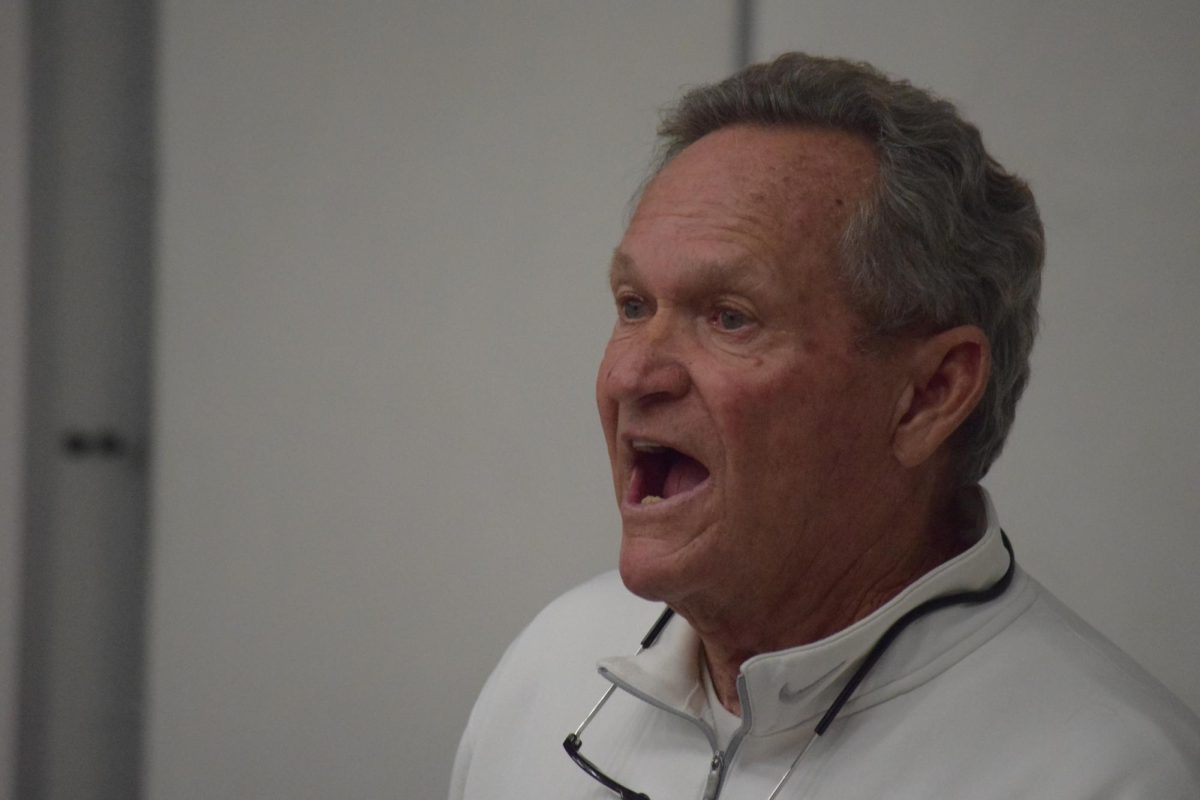

Debt forgiveness doesn’t apply to future borrowers, however. Economics teacher Michael Kraft suspects that many soon-to-be college students might anticipate future debt forgiveness and take out bigger loans for more expensive colleges. At the same time, these choices are still hard for high school students to make.

“Now [my] students aren’t sure,” Kraft said. “They’re like, ‘well, I don’t know if they’re gonna pay off my debt, so how do I make educated decision?’”

Biden announced a plan to provide financial relief for families suffering in the economic fallout from the COVID-19 pandemic and in light of rising college costs. One part of the plan is debt forgiveness: $20,000 of relief to Pell-Grant recipients (who earn less than $125,000 a year) and $10,000 of relief to non-Pell-Grant recipients.

For students like Ikram Chichou, a junior who views college as a key factor to a successful life, the student loan debt relief plan has considerably changed college planning.

“My decision of going to college lies [in] how much money I have,” Chichou said. “[There is] a higher opportunity that I will go to college if the student loan forgiveness continues. If not, then my life after high school has no plan.”

Biden’s plan has reached national headlines and sparked significant controversy surrounding the topic of debt forgiveness. Less discussed, however, are his promises that will impact future borrowers. To the benefit of current and future borrowers, Biden promised to reduce the cost of college and announced that the Department of Education will cap monthly payments for undergraduate loans at 5% of the borrower’s income.

According to Kraft, that cap is a concrete benefit for future Creek graduates planning to take out a college loan, but he doubts many students are aware of that benefit.

“I think the biggest long term impact of it is the 5% cap of your discretionary income, because they are capping what you have to pay in a year towards your debt, and that’s not really what you’re hearing a lot about,” Kraft said.

Marketing teacher Erica Padzic believes the program’s effects vary from person to person, but she thinks the widespread discussion of the issue could have a beneficial impact on the way Creek students think about college. Padzic hopes students will think more about the financial aspect of further education as opposed to choosing a school based on its prestige.

“I’d really like to start seeing kids make decisions that are best for them personally, not what’s best for appearances at Cherry Creek High School,” Padzic said.

![The Class of 2021 gathers at Stutler Bowl during last year’s graduation ceremony. In light of Biden’s debt forgiveness program, this year, some upperclassmen wonder if they will receive similar debt relief in the future. “My decision of going to college lies [in] how much money I have,” Junior Ikram Chichou said. “[There is] a higher opportunity that I will go to college if the student loan forgiveness continues. If not, then my life after high school has no plan.”](https://unionstreetjournal.com/wp-content/uploads/2022/10/6-4-900x675.jpg)